The more revenue available after variable costs are covered, the better, especially considering how expensive fixed expenses like rent and salaries can be. At the very least, a product must have a positive contribution margin to be worth producing. So, even if the product isn’t that profitable, the company can break even as long as the margin is high enough to cover fixed expenses. Additionally, companies can improve contribution margins by adjusting production costs and making processes more efficient. The break even point (BEP) is the number of units at which total revenue (selling price per unit) equals total cost (fixed costs + variable cost).

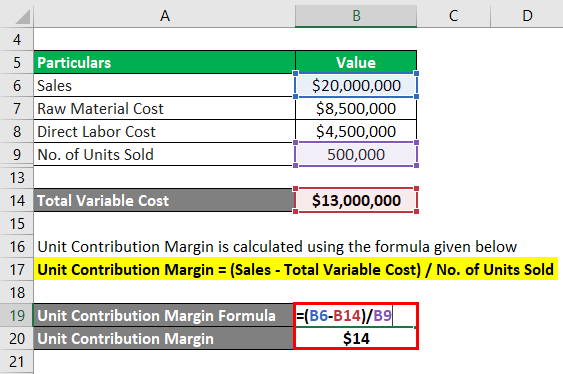

How to Calculate Contribution Margin?

- A key characteristic of the contribution margin is that it remains fixed on a per unit basis irrespective of the number of units manufactured or sold.

- On the other hand, contribution margin refers to the difference between revenue and variable costs.

- Furthermore, sales revenue can be categorized into gross and net sales revenue.

- As mentioned above, contribution margin refers to the difference between sales revenue and variable costs of producing goods or services.

However, a general rule of thumb is that a Contribution Margin above 20% is considered good, while anything below 10% is considered to be relatively low. If the company realizes a level of activity of more than 3,000 units, a profit will result; if less, a loss will be incurred. The insights derived post-analysis can determine the optimal pricing per product based on the implied incremental impact that each potential adjustment could have on its growth profile and profitability. If the contribution margin is too low, the current price point may need to be reconsidered.

How Business Leaders Interpret Cost Behavior and Contribution Margin

You’ll often turn to profit margin to determine the worth of your business. It’s an important metric that compares a company’s overall profit to its sales. However, if you want to know how much each product contributes to your bottom line after covering its variable costs, what you need is a contribution margin. In the Dobson Books Company example, the total variable costs of selling $200,000 worth of books were $80,000.

Total Variable Cost

Learn about the time interest earned ratio and how to calculate it. Get instant access to video lessons taught by experienced investment bankers. Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts. One common misconception pertains to the difference between the CM and the gross margin (GM).

The analysis of the contribution margin facilitates a more in-depth, granular understanding of a company’s unit economics (and cost structure). However, the contribution margin facilitates product-level margin analysis on a per-unit basis, contrary to analyzing profitability on a consolidated basis in which all products are grouped together. Mastering these financial concepts is essential for today’s business leaders. These tools help managers navigate the complexities of modern business, driving sales, profitability and sustainable growth. Instead of doing contribution margin analyses on whole product lines, it is also helpful to find out just how much every unit sold is bringing into the business. Managers then use the analysis to evaluate potential acquisitions and to determine which products should be sold and which should be terminated.

We explain its formula, differences with gross margin, calculator, along with example and analysis. You may also look at the following articles to enhance your financial skills. Well, knowing your contribution margin is like having a GPS for your business. It shows you if you’re on the right path to profitability or if you need to make some adjustments — maybe raise the price of your lemonade, or find a cheaper supplier for lemons. Therefore, we will try to understand what is contribution margin, the contribution margin ratio, and how to find contribution margin.

This insight is invaluable for making decisions about product mix, pricing strategies and resource allocation. For example, a product with a high contribution margin might be worth promoting more aggressively, even if its overall profit margin seems lower initially. To master cost-behavior analysis, business leaders employ a variety of techniques. They immerse themselves in historical data, searching for patterns that reveal how costs have responded to activity changes in the past. Some use statistical tools like regression analysis to quantify these relationships more precisely.

However, you have to remember that you need the $20,000 machine to make all those cups as well. A contribution margin represents the money made by selling a product or unit after subtracting the variable costs to run your business. However, an ideal contribution margin analysis will cover both fixed and variable cost and help the business calculate the hire accountants breakeven. A high margin means the profit portion remaining in the business is more. It may turn out to be negative if the variable cost is more that the revenue can cover. Decisions can be taken regarding new product launch or to discontinue the production and sale of goods that are no longer profitable or has lost its importance in the market.

To calculate the margin, you subtract variable costs (like shipping expenses) from sales revenue — the remaining amount of revenue covers fixed expenses (like rent). Contribution margin is used to help measure product profitability. It helps business owners understand how sales, variable costs and fixed costs all influence operating profit. The contribution margin further tells you how to separate total fixed cost and profit elements or components from product sales. On top of that, contribution margins help you determine the selling price range for a product or the possible prices at which you can sell that product wisely.

11 Financial is a registered investment adviser located in Lufkin, Texas. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links. Profits will equal the number of units sold in excess of 3,000 units multiplied by the unit contribution margin.